Sid Wilson Teeth The Story Behind Slipknot’s Fearless Smile

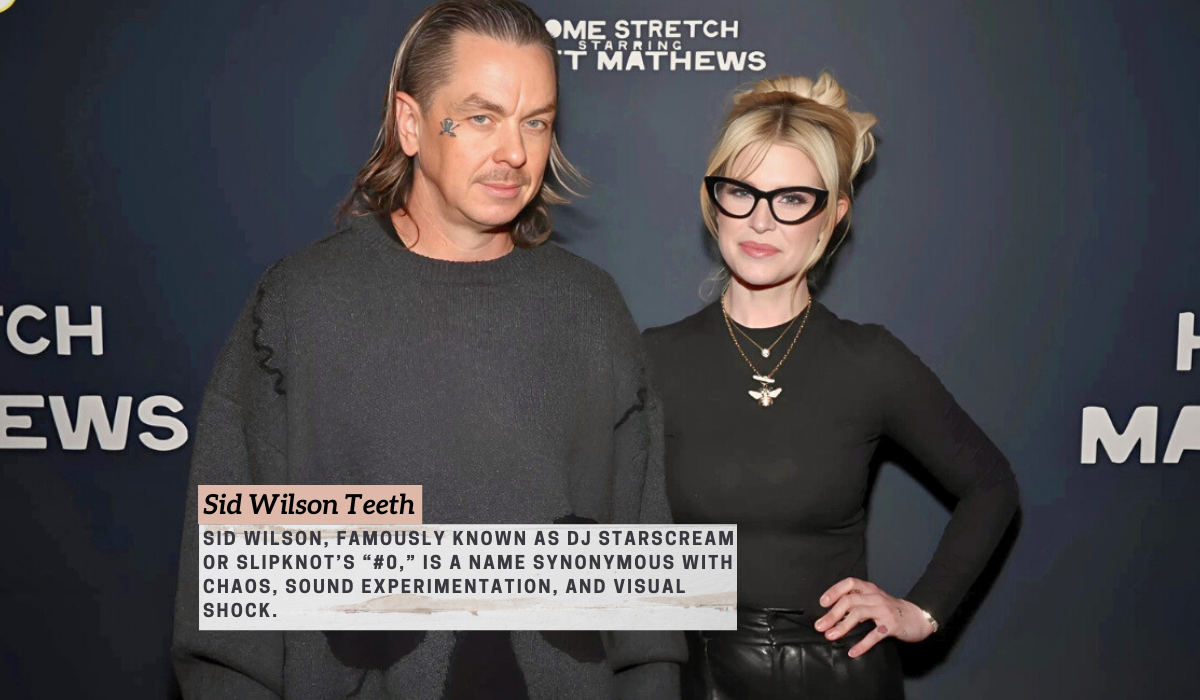

Sid Wilson teeth have become one of the most talked-about aspects of Slipknot’s DJ #0. While fans know him for his chaotic performances, masks, and wild energy, his teeth have taken on a life of their own, symbolizing his unique artistic persona. From gold crowns to an unmistakable grin, Sid Wilson teeth are more than dental work — they are a statement.

Early Life and Rise to Fame

Sid Wilson was born on January 20, 1977, in Des Moines, Iowa, as Sidney George Wilson. Raised in a bicultural environment with English parents, he developed a fascination for music, art, and performance early on. Today, his Sid Wilson teeth are as iconic as his stage identity.

Standing at 5’9” and weighing 68 kg, Wilson joined Slipknot in the late 1990s. Known as member #0, he transformed DJing in metal by blending scratching, effects, and chaotic visual flair — and soon his teeth became an integral part of his recognizable image.

Slipknot and the Birth of a Masked Identity

Slipknot’s identity relies heavily on visual theatrics, masks, and numbers. Sid Wilson’s mask evolution—from gas-mask respirators to robotic skulls—highlighted his persona, but his teeth started to emerge as a unique feature in photographs and performances. Early fans noticed that Sid Wilson teeth were natural, imperfect, and expressive, complementing the raw energy of the band’s shows.

The Evolution of Sid Wilson Teeth

The mid-2010s marked a visible shift. Wilson’s Sid Wilson teeth began to feature gold crowns, shining during performances and interviews. Unlike removable grillz common in hip-hop culture, these were permanent dental crowns, installed for both aesthetic and restorative purposes.

Dental publications like Europe Dental Clinic note that his Sid Wilson teeth crowns likely serve a dual purpose: enhancing his stage persona while repairing minor dental imperfections. The metallic finish aligns perfectly with his theatrical and chaotic image.

Sid Wilson Bio Table

| Attribute | Details |

|---|---|

| Full Name | Sidney George Wilson |

| Stage Name | Sid Wilson, DJ Starscream |

| Nickname/Number | #0 |

| Date of Birth | January 20, 1977 |

| Age | 48 (as of 2025) |

| Place of Birth | Des Moines, Iowa, USA |

| Nationality | American (of British descent) |

| Height | 5 ft 9 in (1.75 m) |

| Weight | 68 kg (150 lbs) |

| Profession | Musician, DJ, Producer |

| Band | Slipknot (#0) |

| Instruments | Turntables, Scratching, Sampling |

| Stage Persona | Masked, theatrical performer |

| Distinctive Feature | Sid Wilson teeth – gold crowns on upper front teeth |

| Early Career | DJ in punk and hip-hop scenes; joined Slipknot in 1998 |

| Solo Projects | DJ Starscream, Swollen Teeth (producer) |

| Notable Events | 2024 bonfire accident causing facial burns |

| Family | Engaged to Kelly Osbourne; son named Sidney (born 2022) |

| Net Worth | Estimated $2–10 million (2025) |

| Physical Appearance | Tattoos on arms and neck; lean build; striking gold teeth |

| Social Media | Instagram: @sidthe3rd |

| Cultural Impact | Influential in metal DJing; Sid Wilson teeth iconic part of branding |

| Trivia | Known for stage stunts, breaking heels during performances, and blending hip-hop aesthetics with metal visuals |

Style, Symbolism, and Stagecraft

Sid Wilson teeth are more than cosmetic—they’re a bold statement. Gold teeth historically symbolize wealth, rebellion, and cultural defiance. By integrating them into metal performance, Wilson bridges genres and cultures, turning Sid Wilson teeth into a visual metaphor for individuality.

According to Mark Magazine, “His gold teeth are both a style choice and a rebellion against conventional beauty. By changing his smile, he turns himself into living sculpture on stage.” Wilson’s teeth reflect Slipknot’s philosophy: imperfection as art, shock as performance.

Public Reaction and Media Curiosity

Fans and media alike have scrutinized Sid Wilson teeth, often speculating whether they hide dental damage or missing teeth. Images after his 2024 bonfire accident added to curiosity, with some suggesting swelling or distortion. Credible reports clarified that the burns affected his lower face and arms but left his Sid Wilson teeth intact.

Experts highlight that his gold crowns are likely restorative. According to Europe Dental Clinic, “There is no evidence that Sid currently has tooth decay; the gold crowns would have been placed after any necessary treatment.” This shows that Sid Wilson teeth are both functional and artistic, not simply decorative.

Personal Life and Family

Offstage, Sid Wilson leads a grounded life. He is engaged to Kelly Osbourne, with whom he shares a son, Sidney, born in 2022. Their engagement in 2025 drew media attention, often highlighting his Sid Wilson teeth in public appearances.

Despite fame, Wilson maintains a private social media presence. His Instagram, @sidthe3rd, occasionally shows glimpses of daily life, creative projects, and his recovery after the burn incident—all with his Sid Wilson teeth ever-present.

Career Beyond Slipknot

Wilson’s Sid Wilson teeth have become a subtle hallmark in other projects as well. As DJ Starscream, he explores drum-and-bass, hardcore techno, and Japanese influences. He also co-produces the band Swollen Teeth, whose name echoes the theme, further cementing Sid Wilson teeth as part of his artistic branding.

The 2025 debut album Ask Nothing showcases his musical creativity, with visuals often including close-ups of Sid Wilson teeth, reinforcing his edgy, rebellious image.

Net Worth and Financial Standing

Sid Wilson’s career spanning over two decades has yielded an estimated net worth of $2–10 million. Revenue streams include Slipknot royalties, solo DJ performances, production, and merchandise. Even his teeth, literal and symbolic, represent an investment in his persona: the Sid Wilson teeth crowns are as much part of his image as his masks and stage costumes.

Physical Appearance and Distinctive Style

Sid Wilson teeth complement a striking stage presence. Tattoos cover his arms and neck, while his lean build and piercing gaze enhance his performances. In candid photos, his gold teeth glimmer even without a mask, making them one of his most recognizable features.

His wardrobe blends streetwear, punk, and industrial influences, but his teeth remain the single element that connects his live energy with visual identity. Fans immediately recognize Wilson by his masks and his unmistakable Sid Wilson teeth.

Symbolism and Message Behind His Teeth

The Sid Wilson teeth are a metaphor for individuality and resilience. They defy cosmetic perfection, embracing imperfections as art. In a society obsessed with flawless appearances, Wilson uses his teeth to amplify the band’s philosophy: celebrate uniqueness, embrace chaos, and reject conformity.

Slipknot’s music confronts pain and rebellion; Sid Wilson teeth visually echo that ethos. By smiling with gold-plated, imperfect teeth, he turns a human imperfection into a stage-defining statement.

After the Burn Accident: Recovery and Resilience

In August 2024, a bonfire explosion caused serious facial burns to Wilson. Despite this trauma, his Sid Wilson teeth remained intact, a symbol of resilience and continuity. Fans celebrated the moment, highlighting the enduring presence of his teeth amid adversity.

As reported in People Magazine, “His iconic grin has survived fire, masks, and decades of chaos — a fitting metaphor for Sid Wilson’s endurance.” This incident only reinforced the cultural weight of Sid Wilson teeth as part of his identity.

Legacy and Cultural Impact

Sid Wilson’s influence transcends turntables. Sid Wilson teeth have become part of his legacy, symbolizing rebellion, individuality, and creativity. Musicians and fans alike reference his style, not just his music. His teeth, alongside masks and tattoos, represent a refusal to conform and a commitment to visual and sonic storytelling.

Conclusion

Sid Wilson teeth are more than a smile—they are an emblem of artistry, resilience, and defiance. From imperfect beginnings to gold-crowned statements, they mirror his evolution as a performer and an individual. In a world obsessed with cosmetic perfection, Wilson’s teeth shine as a beacon of authenticity.

Whether performing behind a mask, producing music, or appearing on the red carpet, Sid Wilson teeth are a signature that complements his energy, creativity, and bold persona — an unforgettable mark in the history of metal and performance art.

FAQs

1. Are Sid Wilson’s teeth real or fake?

Sid Wilson’s teeth are real, but he has gold crowns on his upper front teeth, which are permanent dental fixtures. They are part cosmetic and part restorative, enhancing both his smile and stage persona.

2. Why does Sid Wilson have gold teeth?

The gold crowns are a stylistic choice that complements his theatrical and chaotic Slipknot image. They also serve a functional purpose, likely restoring any previous dental damage.

3. Did Sid Wilson damage his teeth in the 2024 accident?

No credible reports confirm any damage to his teeth from the bonfire explosion in 2024. While the burns affected his lower face, his gold crowns remained intact, continuing to define his iconic smile.

4. Are Sid Wilson’s teeth part of his brand?

Yes, his teeth are a distinctive feature that enhances his public and stage image. The metallic, slightly irregular appearance reflects the band’s aesthetic of imperfection and rebellion.

5. How did fans react to Sid Wilson’s teeth?

Fans and media have been fascinated by the unique look. Some admire the boldness and originality of his gold teeth, while others speculate about dental work, but most agree it matches his Slipknot persona perfectly.